SIOR Europe’s third ski weekend will be held from Thursday 23rd through Sunday 26th January 2025 in Chamonix Mont Blanc, France.

For a world of information about Chamonix Mont-Blanc, visit the tourist office’s website here.

Email us now to find out more and to register your interest.

On behalf of Andrew Smith SIOR FRICS, President of the SIOR European Chapter and the members of the European Chapter leadership, we wish you all a very Merry Christmas and a healthy and prosperous New Year!

This year’s Christmas card shows a small selection of our members in action: networking, doing business, making friendships and overall enjoying our unique culture while taking our chapter from strength to strength.

The New Year will bring new faces and new exciting opportunities. 2024 will also be a special year in view of our bi-annual highlight, the 4th SIOR International Conference in Berlin. Register now to make use of the early-bird rate and keep an eye out for all upcoming events and we look forward to seeing you there.

In the meantime, we wish you a joyous festive season in the hope that those suffering will also find peace and comfort from our continued support and prayers. .

For the first time, ‘transitioning away’ from fossil fuels has featured in a climate deal. Agreed at COP28, 200 countries have signed up, setting a new standard and ambition for global climate action. Against the backdrop of this critical shift, it’s time for real estate to step up and play its part, especially in moving to renewable energy sources and promoting energy efficiency.

It is widely known that the built environment accounts for 37% of energy-related global carbon emissions: 28% from operational emissions, and the remainder from materials and construction. It also has enormous potential to be a catalyst for positive change. So, as COP28 comes to a close, we’ve gathered observations and insights from our team and network, with an overwhelming consensus to accelerate action to deliver transformational impact.

To set the context, here’s a reminder of the targets:

Anna Tsartsari, Co-Founding Director and Head of ESG and Sustainability at BE Design, also one of 1,400 signatories of a letter to the president of COP28 demanding Nationally Determined Contributions and National Adaptation Plans well before COP30 in 2025, says: “Targets are great and necessary, but we must move from commitment to action. We must also be clear about targets – 1.5 degrees is the limit, not a target. The earth is on the verge of five catastrophic tipping points according to the Global Tipping Points report and unless we take urgent action to reduce greenhouse gas emissions, we risk sudden and irreversible changes that threaten the future health of our planet. We welcome the transition away from fossil fuels. It’s a much-needed turning point that will contribute to an acceleration in renewable energy projects, the protection of our forests and energy efficiency.”

To help galvanise the global community and encourage action, the 6th December at COP28 was dedicated to “Multilevel Action, Urbanization and Built Environment/Transport”, highlighting solutions to transition to low-carbon and resilient-built environments and infrastructure, including The Buildings Breakthrough initiative aimed to accelerate a transition to sustainable buildings by 2030, targeting near-zero emission and resilient buildings.

This focus follows the establishment of the #BuildingtoCOP coalition by the World Green Building Council (WGBC) in 2021, bringing together a group of sustainability-focused built environment NGOs and organisations, alongside the UN High Level Climate Champions, to position the built environment as a critical sector for a resilient and zero emissions future at COP conferences. To further promote action, it set up the Net Zero Carbon Buildings Commitment, which recognises and promotes advanced climate leadership action in decarbonising the built environment by 2030, to inspire others to follow suit. It has 180 signatories, represents 20,000 assets and 7.2 million tonnes of CO2 emissions.

The potential for transformational change in and through the built environment is clear. The IPCC, in a report published in 2022, stated that building sector mitigation policies can reduce greenhouse gas emissions by 80 to 90%, and lift up to 2.8 billion people out of energy poverty. WGBC estimates that decarbonising the built environment amounts to an investment opportunity worth $24.7 trillion across the globe by 2030.

Paul Danks, International Representative Board Member of SIOR and former European Chapter president, said: “Businesses are driven by financial concerns and governments have a responsibility to sustain their economy, so the investment opportunity should not be understated. Being more sustainable makes commercial sense – it’s the smart decision, for financial growth and to avoid obsolescence as well as being the right thing to do, for society, resilience and the survival of future generations.”

Andrew Smith, President of SIOR Europe and Partner at Carter Jonas, added: “With members across the continent of Europe and the UK, we see trends clearly. In the last year, the market has been defined by uncertainty, but with one constant – the growing importance of ESG and sustainability. To those in our sector who say climate related interventions are cost-prohibitive, they need to look to market demands, driven by investors and occupiers who want more sustainable real estate. If they want to safeguard their business, they need to do something. This is not an opt-in or out choice.”

Matthew Leguen de Lacroix, Head of Business Development EMEA at SIOR, concluded: “We can do so much as an industry – the power to make an enormous impact is quite literally in our hands. Talking about solutions and sharing best practice are of course important but it will only matter if we act. As King Charles eloquently put it in his opening address at COP28, ‘in 2050 our grandchildren won’t be asking what we said, they will be living with the consequences of what we did or didn’t do.’ Time is of the essence and business, organisation, cities, governments and the general public will need to work together to make a difference.”

SIOR members, many of which are driving the innovation and change the industry needs, will convene at the 4th SIOR International Conference next year. Taking place on 17-19 July 2024 in Berlin, ESG, net zero and whole life carbon will all be front and centre.

The CPN’s Business Development Group, Carl Bradley, talks with Matthew Leguen de Lacroix, SIOR, FRICS, who is SIOR’s Head of Business Development, EMEA.

Read the blog on CPN’s website by clicking here.

We call upon our members and affiliates to join the CREW Initiative in supporting diversity in the Commercial Real Estate profession. Sign the CEO-driven pledge to advance women and DEI in the Commercial Real Estate Industry. For more information scan the QR code provided below.

We are pleased that some of our SIOR Europe members are already part of CREW Network, including Anna Tsartsari, Paul Danks SIOR FRICS and Matthew Leguen de Lacroix SIOR FRICS.

Press release, 28th September 2023.

The European Chapter of the Society of Industrial and Office Realtors (SIOR), the leading global association for real estate brokers, has gathered market insight from its members on the outlook for the real estate sector in key markets across Europe. In summary, the market is facing many challenges including financing, reduced capital market values, rising inflation and interest rates, spiralling construction costs, while meeting the demands of ESG requirements, and an entirely new post-pandemic office market.

Download the full report here.

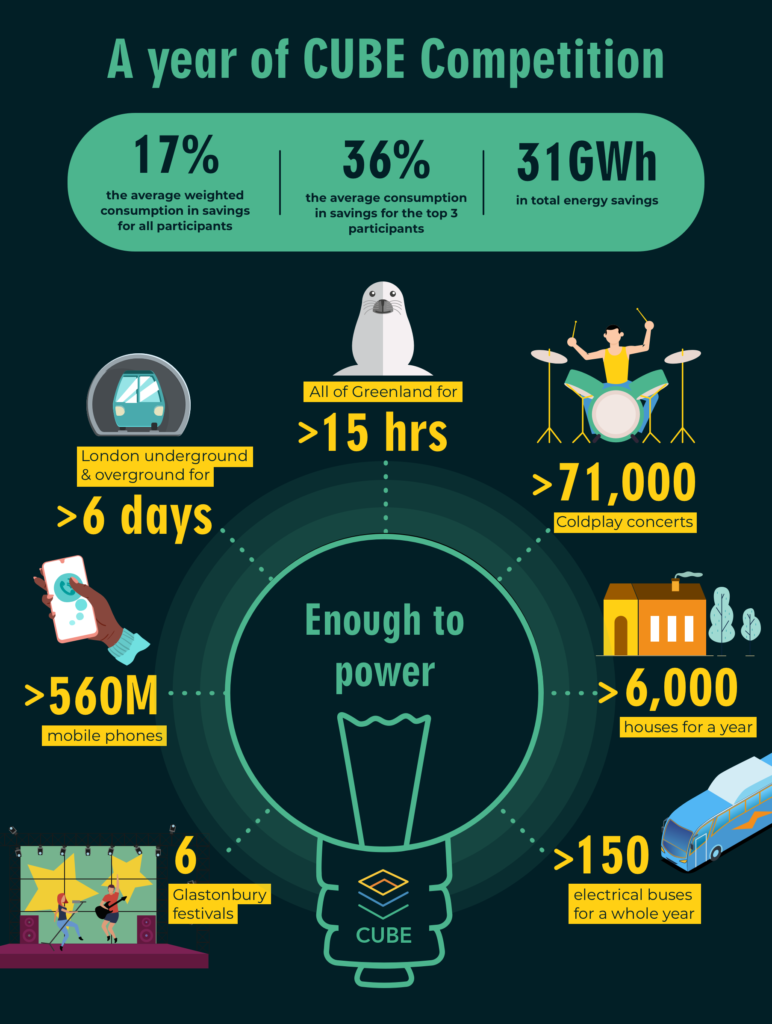

SIOR Europe supported CUBE initiative shows UK office market could be saving 3 million tonnes of carbon annually.

SIOR Europe pledged its support to CUBE over a year ago as it entered the UK office market for the first time. Well established in France, it is the first major initiative to use gamification to tackle energy wastage in commercial buildings and improve landlord and occupier engagement to deliver results. We pledged our support, endorsing it and helping to spread the word.

It announced its first year results in an award ceremony last night. Here are the highlights:

Using an innovative approach to bring landlords, building managers and occupiers together, CUBE has mobilised participants to reduce energy consumption through changing behaviour – the logical first step to net zero. The inaugural year of the competition featured 30 participating buildings, ranging from grade II listed buildings to iconic skyscrapers like the “Walkie-Talkie” and the “Cheesegrater”. At its awards ceremony, hosted in partnership with Nuveen Real Estate and BNP Paribas Real Estate at 70 St Mary’s Axe, it unveiled impressive total savings.

Applying these savings to the circa 860 million sq ft of office space across England, for example, the UK, a staggering £3.8bn a year in energy costs could be saved, not to mention nearly 3 million tonnes in carbon reduction.

At the event, awards were given for buildings in the Historical data category, where they were challenged to compete against their own past energy consumption. The winning building at 40 Holborn Viaduct, owned by Nuveen and managed by BNP Paribas Real Estate slashed 38.8% of its energy. The iconic 20 Fenchurch Street owned by H Properties and managed by Savills snagged second place ,while XLB’s The Tootal Buildings managed by Ashdown Phillips came in third place.

Awards were also given in the AV league, which focuses on newly built or refurbished buildings, and which looks at absolute value, whereby building are given an absolute energy budget based on UK Green Building Council Office Energy Intensity Targets. The Frames owned by Workspace came out top, followed by RO’s GNR8 and The Howard de Walden’s Estate’s head office at 23 Queen Anne Street.

With the first year of the competition concluding, the results produced some interesting findings. The expectation was that large buildings would do significantly better, but medium-sized buildings stole the spotlight saving 18% annually, compared to 12% for large sized buildings.

Another surprising result was the BREEAM-certified buildings still had a large capacity for energy savings, with a substantial average energy saving of 22%. In all, the average energy intensity of CUBE buildings before the competition was 262 kWh/m², but after the competition, this reduced considerably to 215 kWh/m². While significant, buildings across the UK will need to continue their efforts to meet UK Green Building Office Intensity Targets of 90 kWh/m2 by 2030.

Finally, CUBE can reveal that buildings in Manchester achieved outstanding energy savings, with an average of around 20%. One Victorian building in Manchester stands out by making a significant contribution to these impressive savings, highlighting the potential for energy-efficient transformations even in Grade II listed buildings.

Further key stats:

Matthew Leguen de Lacroix, Head of Business Development EMEA, said: “We knew how successful CUBE had been in France and so when we were asked to endorse a UK version of the competition, we didn’t hesitate. SIOR is all about promoting best practice and driving the real estate sector to perform at the highest levels. We’re delighted to see such brilliant results in just 12 months and hope this galvanises more landlords and occupiers to get involved in season two.”

Mark Bruno, Chief Ambassador of CUBE, said: “Real estate contributes a disproportionate percentage of worldwide carbon emissions, but despite the industry’s best efforts, the latest Savills research still indicated that 39% of global carbon emissions still come from the sector, with operational emissions alone accounting for 28%. Our goal was to galvanise the industry into taking stronger action, using the tried and tested tool of gamification. By encouraging participants to adopt the spirit of competition, they strive to reduce the carbon footprint of their commercial buildings, while also coming together to share experiences and successes. The competition’s first year has delivered some impressive results, and we’re delighted that so many big names from across the real estate world jumped at the opportunity.”

The second season of CUBE is already in process with an ambition to show the collective impact of 100 buildings, old, new, refurbished or listed across the UK. If you think your workplace or that of someone you know should take part, get in touch with the CUBE team.

On Thursday, 11th May, SIOR Europe held a networking event at Carter Jonas’ Chapel Place office in association with St Catherine’s College, Cambridge. Speakers tackled the question ‘Is structural change more important than the economic cycle as a driver of the CRE market?’. It was attended by approximately 30 Cambridge students and 40 real estate professionals.

Daniel Francis, Head of Carter Jonas’ Research Team, gave a presentation covering issues such as the retail & office demand drivers, changes within the industrial sector, labour market constraints and the impact of AI on the industry.

Andrew Smith FRICS SIOR, President of the SIOR European Chapter and Head of Carter Jonas’ Industrial Team, followed with another presentation about ‘The Industrial/ Distribution Sector and Open Storage Market’, covering the need to embrace sustainability, exploring the concept of open storage & its benefits and the explanation of the Distribution Sector & economy.

During the networking cocktail the students had the opportunity to interact with industry professionals and clarify questions.

Andrew Smith, Partner, Commercial, Carter Jonas, commented: “It was a pleasure to welcome so many colleagues, friends and students from across our network to Carter Jonas’ head office for the opportunity to discuss the latest advancements in our sector. Understanding the drivers of demand and growth in our market, including the significant contributions from e-commerce and ‘just in case’ supply chain needs, is key to anticipating future trends. Examining these issues alongside the key challenges of rising occupancy costs, labour market constraints and ESG considerations, including net zero ambitions, made for a compelling and interesting discussion.”